Today there's more options than you think

As a homeowner, you’ve likely built equity over time. One of the benefits is that you can tap into your home’s equity to improve its value or purchase a new home.

What’s home equity? It’s the difference between the current market value of your home and the amount you owe on your mortgage. Before you put it to use, there’s a few things you should know.

Understand exactly what equity is and how it grows.

Bankrate explains it like this:

“Home equity is the portion of your home you’ve paid off – your stake in the property as opposed to the lender’s. In practical terms, home equity is the appraised value of your home minus any outstanding mortgage and loan balances.”

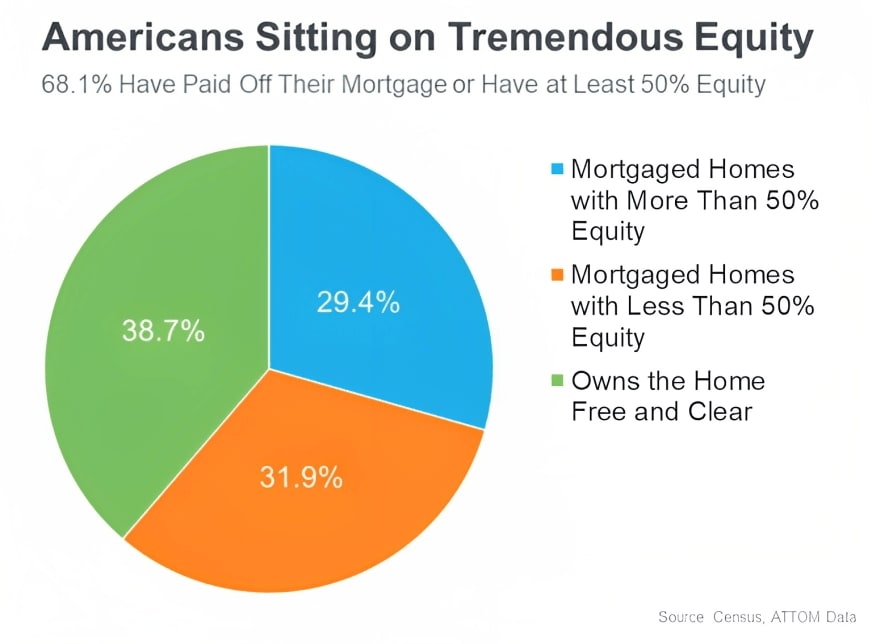

Many Americans have built a large amount of equity in their home. If you’ve owned your home for a while, you’ve likely built up some equity – and you may not even realize how much. Based on data from the U.S. Census Bureau and ATTOM, the majority of Americans have a substantial amount of equity right now (see graph below):

Your home equity benefits you in more ways than one. Rick Sharga, Executive Vice President of Market Intelligence at ATTOM, explains:

“Record levels of home equity provide security for millions of families and minimize the chance of another housing market crash like the one we saw in 2008.”

Over time, your home equity grows. In addition to providing financial stability while you own your house, when you’re ready to sell it, that money could go a long way toward paying for your next home. But you don’t have to sell your home to take advantage of this.

Want to improve your home’s value? There are several ways to use your home’s equity to do so:

1. Home Equity Loan: A home equity loan is a second mortgage that allows you to borrow against the equity you’ve built up in it. Typically a fixed-rate loan with a set repayment term, the funds can be used for any purpose. It’s a good option if you have a specific project in mind, such as a home renovation or addition, and want a predictable repayment plan.

2. Home Equity Line of Credit (HELOC): A HELOC is a revolving line of credit that allows you to borrow against your home’s equity as you need it. The interest rate is typically variable and may be lower than a home equity loan, but there may be fees involved. It’s a good option when you have ongoing home improvement projects or need the flexibility to borrow as needed.

3. Cash-Out Refinance: A cash-out refinance allows you to replace your current mortgage with a new one that has a higher balance and receive the difference in cash. It’s great when you want to access a large amount of your home’s equity at once and might result in a lower interest rate.

4. Home Equity Investment: A newer option for accessing your home’s equity is a home equity investment. With this option, you sell a portion of your home’s future appreciation in exchange for a lump sum of cash. The investor shares in any future appreciation but doesn’t receive any ongoing payments or interest. It’s a good option if you want to access your home’s equity without taking on additional debt.

5. Reverse Mortgage: Also good option if you want to access your home’s equity without taking on additional debt, reverse mortgages don’t require good credit to be approved. However, you will have to prove your ability to keep the property maintained and be able to pay your tax and insurance bills. You will also be required to undergo financial counseling before you qualify. However, if you are already retired, need to supplement your income, aren’t willing to downsize, and don’t want to leave your home to your heirs, then it might be be the best option for you.

THE BOTTOM LINE

When using your home’s equity, you’re borrowing against an asset you’ve worked hard to build. It’s crucial to have a plan for how you’ll use the funds along with a realistic repayment and maintenance plan that fits your budget. Additionally, be aware of any fees or closing costs and any ongoing requirements associated with each of these options.

Overall, it can be a smart way to improve its value or purchase a replacement home. Before taking action, consider your options carefully and work with a qualified professional team to help you determine the best strategy. Your financial advisor, tax advisor, your lender, and your real estate advisor can help provide you with the best strategy, tailored for your unique needs.

For expert advice on how to position you to maximize the value of your home in a shifting market, let’s connect to explore your options.

Call me or text me for a confidential, no-obligation consultation. For text inquiries, please use the keywords, “real estate inquiry.”

I look forward to hearing from you.